The end may be near for Diem.

Getty ImagesIt may be the end of the day for Diem, Meta’s troubled cryptocurrency.

Facebook parent Meta and its partners in the Diem Association are reportedly pulling the plug on the yet-to-launch cryptocurrency project amid growing resistance from regulators.

Earlier this week, Bloomberg reported that the association, which oversees the digital currency, is considering a sale of its assets in order to return capital to its members. Discussions are still early, the news service reported, and are focused on how a sale of its intellectual property might work and where the engineers who developed Diem might find jobs.

Meta owns about a third of the project, according to Bloomberg’s unnamed sources, with the remainder in the hands of a variety of investors, including Uber, Shopify and Union Square Ventures.

A Diem spokesperson declined to comment on the reported sale. Meta didn’t respond to a request for comment.

Diem has been scaled back since it was first pitched as Libra in 2019 by Facebook as a global stablecoin. Like Facebook, the cryptocurrency rebranded, adopting the Diem name in December 2020 as concerns mounted. The project faced more trouble when David Marcus, one of the executives behind Meta’s push into cryptocurrencies, said last year that he would leave the company to pursue entrepreneurial projects.

Diem hasn’t gotten much love in its brief history. Partners have bolted from the project, details have shifted and legislators have criticized the plans. Meta’s launch of a cryptocurrency wallet called Novi prompted a backlash, with a group of five Democratic senators urging Meta CEO Mark Zuckerberg to stop the Diem project.

Though Diem’s days look numbered, Meta hasn’t formally closed its work on the cryptocurrency. Here’s what you need to know.

Why does Facebook want a cryptocurrency?

Diem isn’t actually Facebook’s cryptocurrency. It’s a project of the Diem Association, which Facebook originally co-founded as the Libra Association. If the cryptocurrency gets launched in its current form, the association will serve as its monetary authority. The project says its purpose is to “empower billions of people,” citing 1.7 billion adults without bank accounts who could use the currency.

Of course, Facebook has its own interest in digital cash, which predates Diem. The social network ran a virtual currency, called Credits, for about four years as a way to make payments on games played within Facebook.

Zuckerberg has said sending money online should be as simple as sending photos. Diem is designed to make it easier and cheaper for people to transfer money online, which might also attract new users to the social network. Zuckerberg has acknowledged that having people use cryptocurrency would likely benefit Facebook by making advertising on the social network more desirable and, therefore, more expensive.

Meta’s Novi subsidiary runs a wallet for holding and using the digital currency and says its mission is “helping people around the world access affordable financial services.” Analysts at RBC Capital Markets have said those services will likely include games and commerce.

Would Meta have direct control over Diem?

No. Meta is one of the members of the Diem Association, the nonprofit that will serve as a de facto monetary authority for the currency. (Meta’s membership is through Novi.) The association had hoped to grow to 100 members, most of which will pony up $10 million to get the project going. Each member has the same vote in the association, so Meta doesn’t technically have any more say over the association’s decisions than any other member.

That said, Meta has played an outsize role in the initial phases of the project. After the network is launched, Meta says, the social network’s role and responsibilities will be the same as those of any other founding member.

Why have association members dropped out?

Some of the bigger founding members appear to have gotten cold feet. Seven of the original 28 founding members — that’s a quarter of them — dropped out before the association’s inaugural meeting in Geneva. Those exiting included PayPal, eBay, Stripe and financial services giants Visa and Mastercard. The departures are big losses because those members brought expertise in payments and transfers technology. The other dropouts are Mercado Pago, the online payments platform of Argentina’s Mercado Libre marketplace, and Booking Holdings, an online travel company that runs sites including Priceline, Kayak and OpenTable.

The association currently has 26 members.

How is Diem different from other cryptocurrencies?

Let’s start by addressing how it’s similar to other cryptocurrencies, such as bitcoin and ether. Like them, Diem, if it makes it to the world, will exist entirely in digital form. You won’t be able to get a physical note or coin. And like other cryptocurrencies, Diem transactions will be recorded on a software ledger, known as blockchain, that confirms each transfer. The Diem blockchain will be managed by the founding members in the early stages but is supposed to evolve into a fully open system in the future.

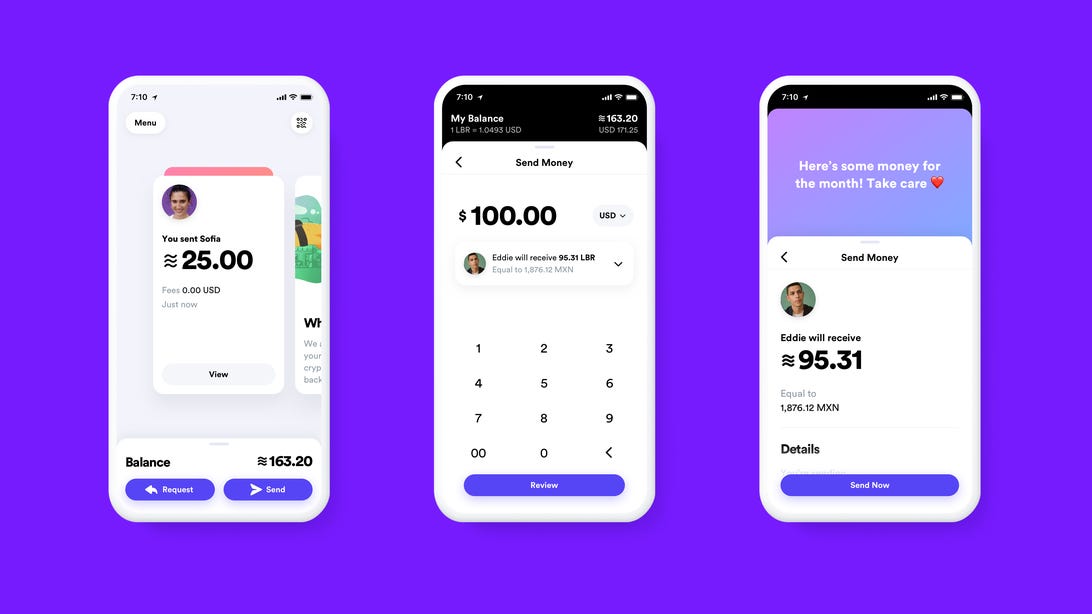

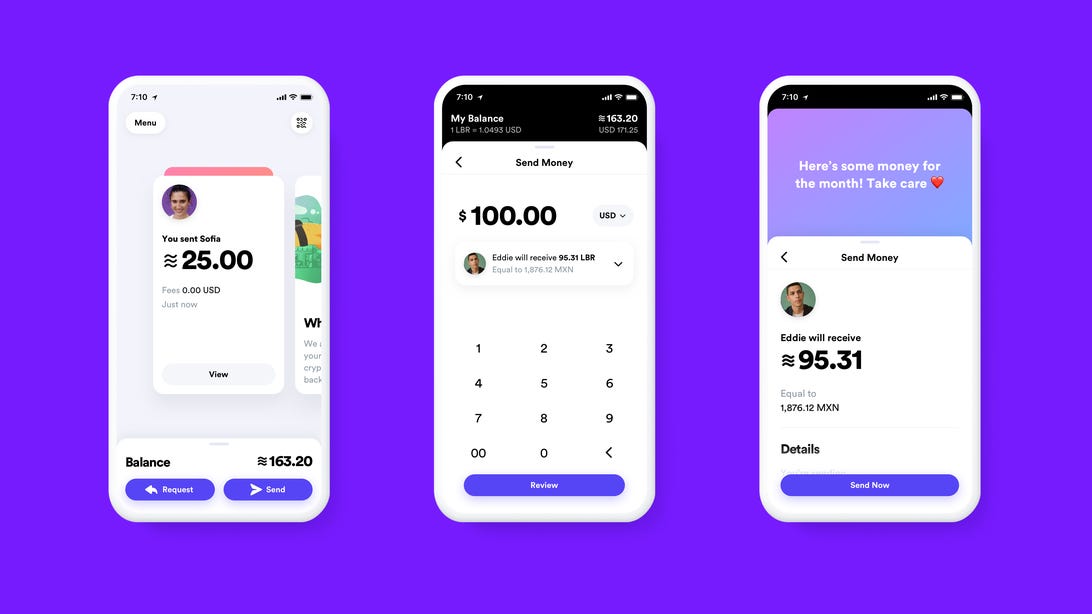

Here’s what a wallet could look like on a phone.

FacebookDiem will be pegged to the US dollar, a format widely known as a stablecoin. That contrasts with bitcoin, ether and some other cryptocurrencies that aren’t backed by anything and swing wildly in response to speculation.

Initially, the plan was to use a basket of assets to anchor the cryptocurrency’s value. The association didn’t say what those assets would be but indicated they’d be denominated in major global currencies, like the dollar and the euro, which don’t fluctuate intensely day to day. The association would buy more of the underlying assets to create, or “mint,” new Diem when people want more of the cryptocurrency. When people cash out, the association will sell those assets and “burn” Diem.

Backing a currency with an asset isn’t anything new. In fact, it used to be common. The US dollar was backed by gold until 1971. The value of the Hong Kong dollar is pegged to the US dollar and managed by a currency board, which can issue new notes only if it has enough in reserves.

How do cryptocurrencies compare to the dollar?

The US dollar is tried and true and pretty much accepted anywhere in the world. Some countries like the dollar so much that they use it instead of their own money. Dollars earn interest, though at current rates that won’t add up to very much.

Of course, the dollar has weaknesses. Using dollars, particularly across borders, can be expensive because banks take a cut to convert them into local currencies. If you’re using dollars on a prepaid card, the credit card company is probably charging the merchant a portion of your purchase. If the US government prints too many dollars, inflation could follow.

Despite the hype, cryptocurrencies aren’t widely used yet. Try buying a cup of coffee with ether. (Yes, it’s possible but not practical.) The value of cryptocurrencies is volatile, often rising or falling more than 5% a day, making it difficult to get a sense of the long-term worth of the asset.

Cryptocurrencies can make it easy to send money directly to someone. Bitcoin transactions aren’t actually untraceable, though they can be very difficult to trace. Similarly, bitcoin use isn’t absolutely anonymous. It’s pseudonymous, meaning that your bitcoin address is recorded even though your identity isn’t.

Some cryptocurrencies, notably bitcoin, have a cap on the number of coins that can be minted, meaning that owners of existing coins don’t have to worry about the arbitrary creation of new ones, although that could create other issues in the future.

Is Diem just a ploy so Meta can get my financial data and send more targeted ads?

We hear you. Meta and its Facebook social network don’t have great reputations for privacy protection.

The social network says don’t worry — not that you expected it to say anything else. When the plans were first unveiled, Meta took pains to point out its wallet was housed in a subsidiary of the social network. The arrangement was designed to allow the wallet company to be regulated by authorities and prevent money laundering and other financial crimes. The company also said it would keep financial data separate from Facebook’s social data.