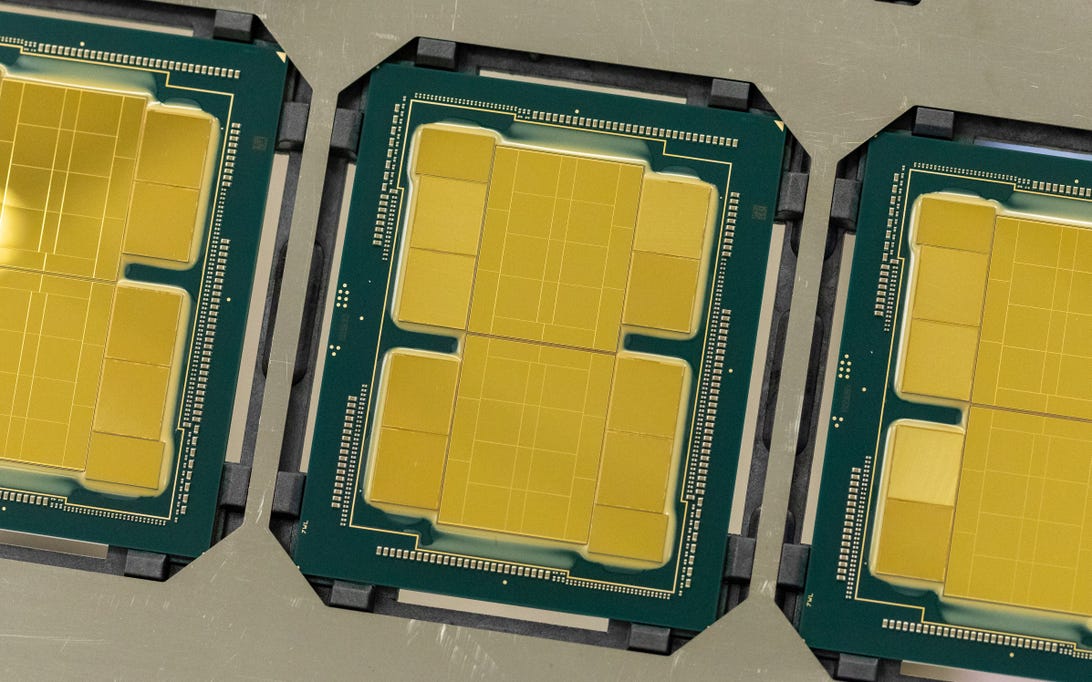

Intel’s Ponte Vecchio processor uses advanced packaging techniques the chipmaker plans to offer automakers, too.

Stephen Shankland/CNETIntel on Thursday announced a new division to design and sell chips that will help carmakers modernize vehicles and the processors that power them.

The chipmaker is trying to cash in on a fast-growing market for the semiconductors it builds. For automakers, processors in 2019 represented 4% of a car’s cost, but it’s going to soar to 20% by 2030, Intel predicts.

That’s because cars are becoming computers on wheels, with developments like autonomous vehicle technology, driver assistance features like automatic emergency braking, chips that monitor everything from tire pressure to battery temperature, and ever fancier dashboard displays and entertainment systems. Intel already has a presence in the market through its MobileEye subsidiary, which develops advanced driver assistance systems, or ADAS.

Don’t expect to see an “Intel inside” sticker on your next car’s dashboard, but if Intel succeeds, that’ll be what’s actually going on behind the dashboard and under the hood. As chips spread into every product, the world is “at the beginning of what we believe will be a golden age of semiconductors,” Intel Chief Executive Pat Gelsinger said.

Intel unveiled the automotive unit, a new challenge to rivals Nvidia and Qualcomm, at its annual investor day event. It also announced new efforts to improve PC graphics chips, continued progress in modernizing its troubled processor manufacturing operations and the expectation it’ll build a processor with 1 trillion transistors by the decade’s end.

Cars have long used processors to control engines, antilock brakes, in-dash navigation systems and other subsystems. Tesla, which designs its own chips and updates its cars’ software often with over-the-air updates, is at the forefront of a more unified computing approach. Intel’s automotive unit is headed in that direction, offering a computing platform for automakers with building blocks they can choose.

Other carmakers are following suit. Ford CEO Jim Farley said this month that his company needs to design its own central computing brains instead of sourcing them from suppliers. “This takes talent. It takes a different approach. It takes more resources,” Farly said.

Intel’s new automotive unit is part of the Intel Foundry Services division, one of the major efforts Gelsinger adopted to try to reverse Intel’s slide off the leading edge of chipmaking. Gelsinger, who returned to Intel a year ago, hopes to recover from more than a half decade of problems modernizing its chip manufacturing by accelerating progress in a “super Moore’s Law” phase. And he’s boosted by explosive demand for chips he’s calling a new golden age for the industry.

IFS means Intel will build chips for other companies, not just its own designs, a dramatic shift in culture, technology, operations and business relationships. Intel’s earlier foundry efforts faltered, but Gelsinger promises things will be different this time. One data point: Intel has agreed to acquire Tower Semiconductor for $5.4 billion, a deal that would significantly expand the types of chips that the IFS division can make for customers.

Making others’ chips isn’t as profitable as Intel’s existing business, but it plays a role in Intel’s grander plans. Staying competitive with the top two foundries, Taiwan Semiconductor Manufacturing Corp. (TSMC) and Samsung, requires manufacturing chips in massive volume to pay off extraordinarily expensive chipmaking equipment investments. IFS is intended to deliver some of that volume.

If Gelsinger’s IFS vision succeeds, Intel could build chips even for rivals like graphics and AI chip designer Nvidia, PC and server chip designer AMD, and smartphone chip designer Qualcomm. Qualcomm endorsed IFS, but it hasn’t made a public commitment on building a specific product, and it’ll be until years from now if it does.

A major Intel challenge is persuading shareholders to come along for its multiyear recovery plan. Massive investments in new fabs, including “megafab” sites in Ohio and Europe expected to cost $100 billion each this decade, will already are lowering profit margins. New chip fabrication plants, or fabs, cost about $10 billion each these days. Intel also must deliver steady annual progress in manufacturing processes that have been the bane of its business for years.

Intel’s new PC graphics technology

Intel hopes to benefit from making your PC more exciting, too.

After years watching Nvidia and AMD profit from graphics processing units, Intel has begun designing its own GPUs in earnest — though it relies on TSMC to build them. At its investor day, Intel announced its Accelerated Computing Systems and Graphics Group will generate more than $1 billion in revenue in 2022 and expects to increase that to $10 billion by 2026.

It’ll do so with better graphics chips for AI, gaming and professional workstations. The first product in the effort, Intel’s Arc graphics chip for laptops, will ship this quarter. Intel announced three new GPU developments on Thursday, too:

- A project called Celestial will sell graphics chips for high-end gaming desktop PCs.

- Project Endgame will offer Arc graphics chips through a cloud service later this year for a fast-response computing experience.

- A new Falcon Shores design due in 2024 will let Intel’s x86 CPUs and its Xe GPUs plug into a single PC chip socket, quintupling performance per watt and the memory communication link’s speed and capacity.