With the number of vehicles each automaker sells rising thanks to EVs, waning customer loyalty and stiffer competition, things are about to get tough for automakers

September 30, 2023 at 18:15

–>

–>

–>

The automotive market looks very different today than it did even as early as three years ago. Between a pandemic impacting production, the rise of EVs, and changing consumer habits, automakers have to do more than ever with less.

For instance, since the pandemic, more consumers are piling into the luxury vehicle market. Although that may seem like a good thing for automakers — these vehicles cost more and have higher margins — the segment still only accounts for 20 percent of the market. Despite that, there are nearly as many brands competing for that 20 percent of sales (22), as there are competing for the other 80 (27).

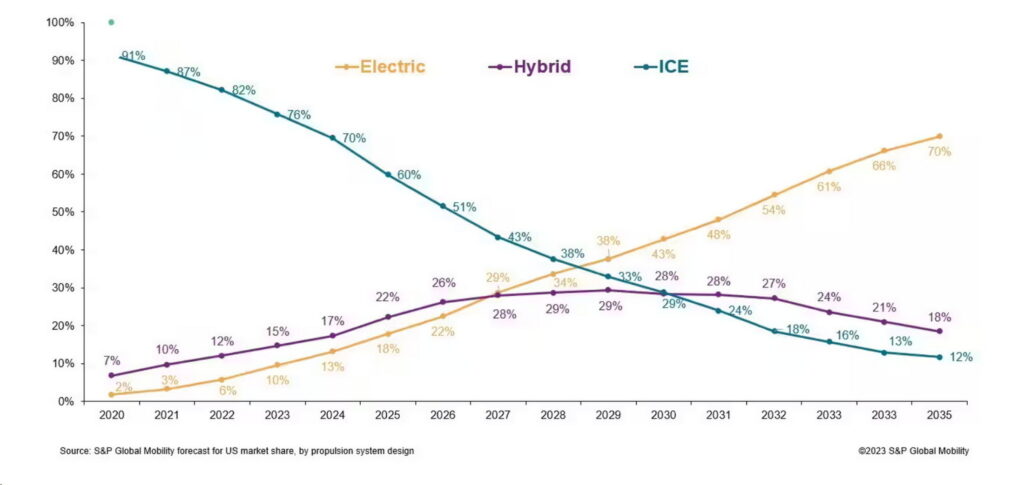

Similarly, rising investments in the production of electric vehicles puts further pressure on automakers. S&P Global predicts that there will be 200 electric models on sale by 2026, and that they will reach a crossover point with hybrid and internal combustion sales by 2029. After that, EV are expected to start taking over, but for now, that means more models than ever to advertise and sell for automakers.

advertisement scroll to continue

Read: $23K Used To Buy A 3-Year-Old Car In 2019, Now It Can’t Even Get You A 6-Year-Old One

In 2018, average sales per nameplate in the U.S. stood at 49,000 units. By 2027, that figure is expected to drop to 36,000, as automakers try to sell electric, hybrid, and internal combustion vehicles to satisfy customers’ varying tastes. The silver lining for auto brands is that, for now at least, consumers appear to be on the fence, too. In seven out of 10 cases, an EV joins a garage without displacing another vehicle.

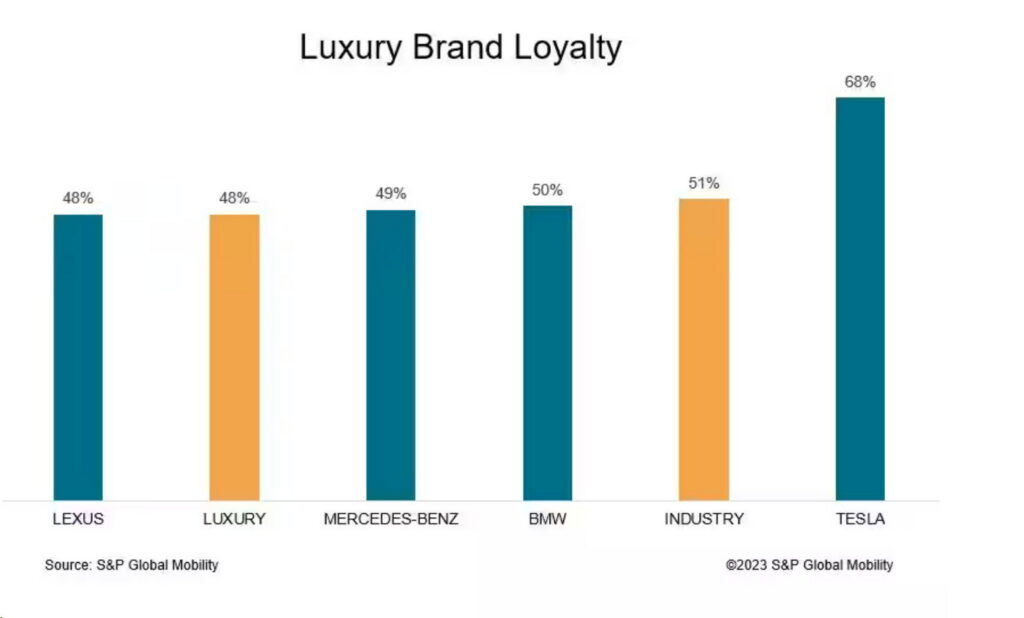

The bad news for the manufacturers is that the brands of each vehicle in that garage are less likely than ever to be the same. In part because EVs are helping brands make conquests, partly because so many brands are competing in the luxury space, partly because leasing rates are lower than ever, and also because the pandemic necessitated a lack of loyalty, 53 percent of shoppers considered themselves to be brand nomads in 2022. Of those, around 60 percent are expected to change brands the next time they purchase a vehicle.

That puts automakers in a difficult spot. Because brand loyalty is low, they have to fight harder than ever for sales. However, with more vehicles to market, they have less money per nameplate to advertise those vehicles.

S&P Global suggests that as a result, automakers will have to target buyers more directly and accurately than ever before. They will need more data than ever on potential shoppers, and will need to analyze that data more closely in order to target the right households.