Despite the drop, Tesla outsold BYD’s 300,114 Q1 deliveries, regaining the top spot in electric vehicle sales

12 hours ago

–>

–>

–>

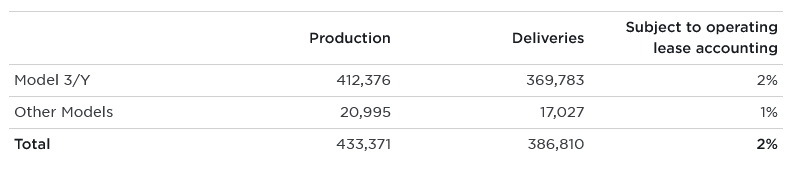

- Tesla delivered 386,810 vehicles in Q1 2024, 8.5% less than Q1 2023 and below analyst predictions.

- Both Tesla and BYD saw significant declines compared to Q4 2023, suggesting a potential slowdown in the EV market.

- Elon Musk suggests Tesla might be entering a period of slower growth, potentially lasting throughout 2024.

Tesla says that it delivered just 386,810 vehicles during the first quarter of 2024, which is 8.5 percent less than it did in Q1 2023. The last time it saw a year-over-year fall was in early 2020. That delivery figure is still far more than BYD’s delivery report of just 300,114 vehicles during the same Q1 2024 period. Here are the details about each result, what they mean for the EV sales crown, and what they could indicate for the rest of the year.

Analysts had predicted that Tesla would deliver roughly 455,000 vehicles, so falling short of that isn’t great. Compared to Q4 2023, Tesla saw a 20.2 percent decline in deliveries. Tesla stock was down nearly 6% in early trading following the release of the report but has since slightly recovered, being 3.5% down at the time of publishing, dropping from $175.12 on April 1st to $168.88. Nonetheless, it did manage to take back its delivery crown from BYD.

More: Elon Musk’s Behavior Is Driving Away Customers

The Chinese automaker made waves when it became the leader in EV sales during Q4 2023. Now, it’s experienced a drop-off of 43 percent compared to Q4 2023. That indicates a decrease in demand across the market and the world. While BYD didn’t specify exactly why it saw a quarter-over-quarter nosedive, Tesla provided a few explanations for its own decline.

Specifically, it blamed the revamping of its Fremont factory for the updated Model 3, shipping diversions caused by the Red Sea conflict, and shutdowns at its Berlin plant. However, do these factors fully account for the surplus of some 47,000 vehicles that it couldn’t sell? Perhaps not. Elon Musk told investors in January that the automaker was “between two major growth waves.”

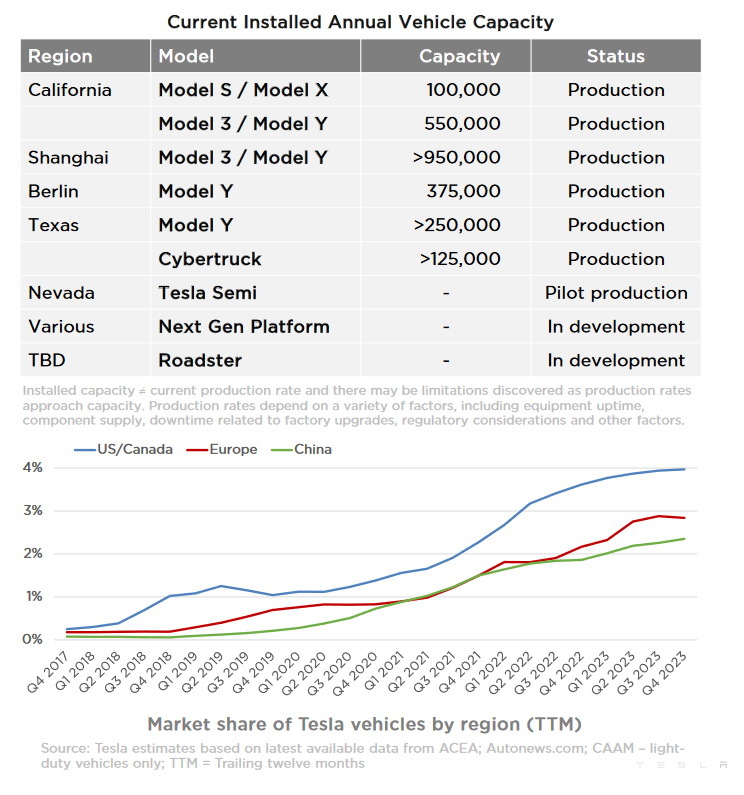

What this suggests is that there could be a slowdown for an extended period, perhaps even throughout the year, depending on various factors. The entire EV industry seems poised for a market correction. While legacy automakers like Ford, Chevrolet, and Stellantis can adjust by increasing ICE or hybrid production, Tesla doesn’t have that option. How it navigates the next 9-12 months will be crucial for achieving its short-term goals.

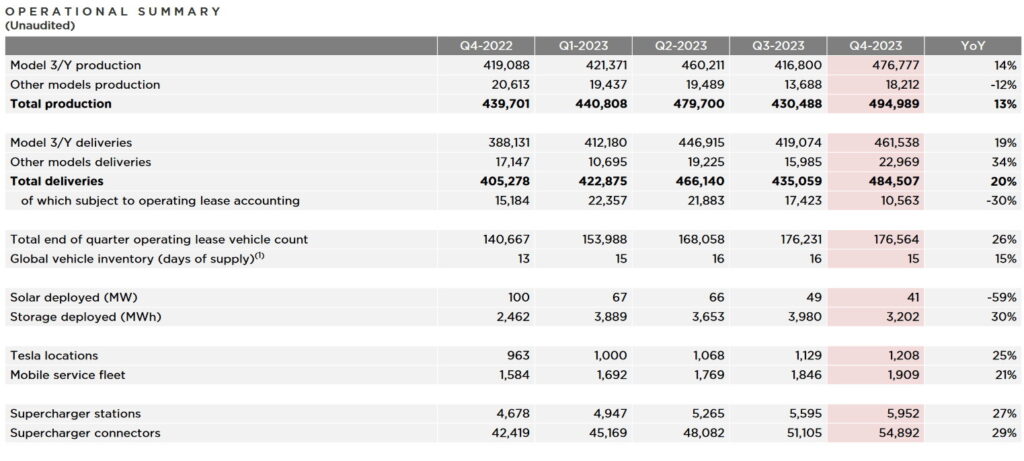

Quarterly Summary

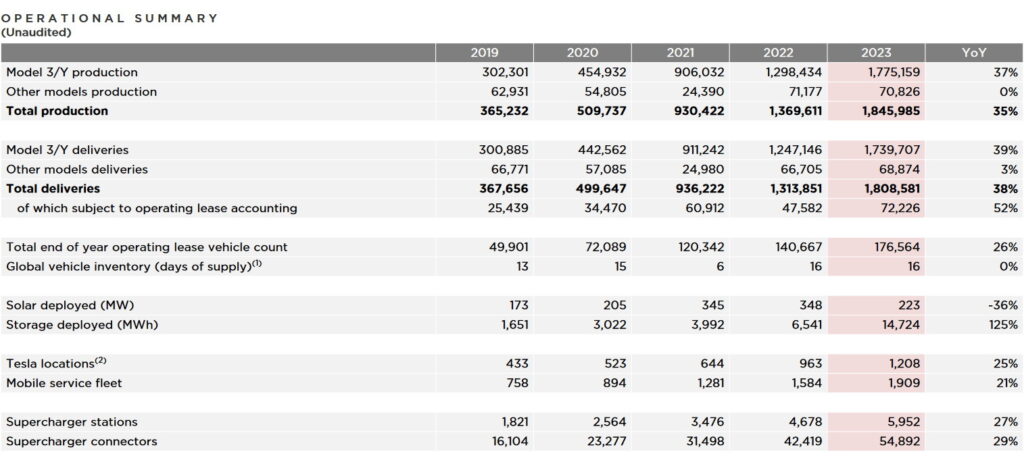

Annual Summary