–><!—->

The laws of supply and demand can be cruel to buyers looking for an affordable used car in today’s world

May 8, 2023 at 19:37

–>

–>

by Thanos Pappas

–>

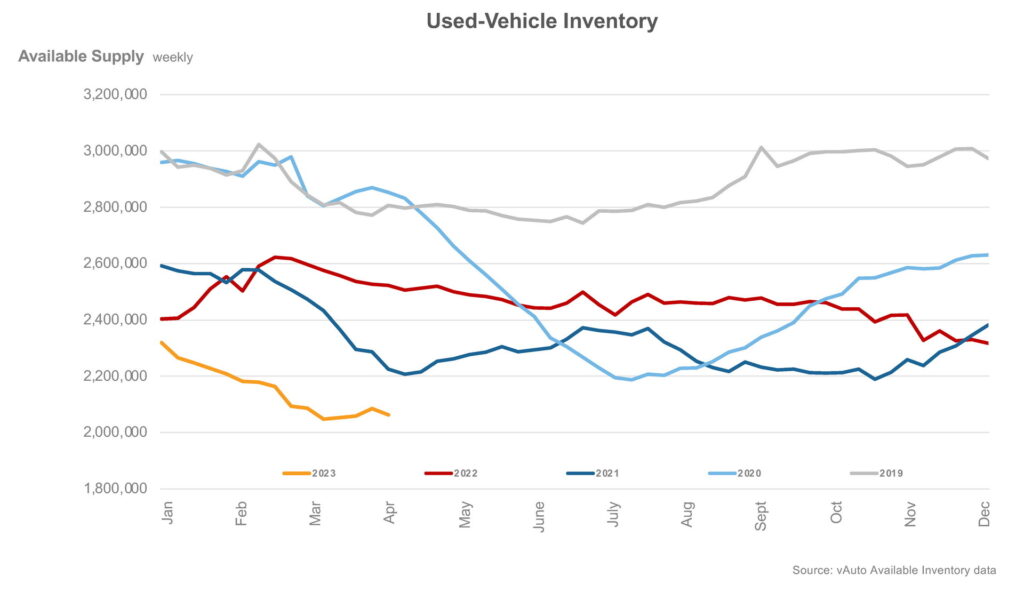

Three and a half years after the outburst of the pandemic, the average used car price shows a massive increase, while the inventory of used vehicles in the US is at the lowest level in more than a decade. So what caused that surge? The answer lies in the very low rates of new vehicle production during the past few years, which eventually led to fewer cars ending up in the used market.

According to Cox Automotive, everything started with the sudden global halt of automotive production in the spring of 2020 due to COVID-19, which lasted for months. Initially, people stopped buying cars due to the lockdowns and the financial uncertainty, but very soon the market rebounded in an unprecedented way. Buyers got out of their homes with cash in their pockets, causing demand for new cars to skyrocket. At the same time, automakers couldn’t ramp up production due to supply issues and the global semiconductor shortage. As a result, new vehicle inventories plummeted from 3.8 million units in the spring of 2020 to 820,000 in the fall of 2021.

In total, automakers sold 8.1 million fewer vehicles in the 2020-2022 period compared to 2017-2019. This huge difference means that much fewer cars ended up in the used market. The effect was accentuated because two major sources of used vehicles took the biggest hit – leasing is down by 28% and rentals by 58%. No wonder why the 2 million units of the current used vehicle inventory in the US is the lowest number in more than a decade and a full million less compared to the pre-pandemic levels.

Brian Finkelmeyer from Cox Automotive reports that before COVID-19 was a thing, the average used car cost $19,827 and had 65,000 miles on the clock. Today, those numbers have been increased to $26,686 (+35%) and 71,000 miles (+9%), making cars less attainable to low-income buyers. This is combined with a significant increase in new car prices due to higher production costs and the fact that automakers focus on higher-margin segments, often abandoning their mainstream offerings. Interestingly, the popular compact/midsize sedan and compact SUV segments accounted for 74% of the production cuts.

As proven by the rapidly growing revenues of automotive servicing firms, most people tend to keep their vehicles for longer instead of looking for a replacement. Judging from the latest forecasts, this trend is probably not going to change dramatically in the next few years, with car prices remaining higher than normal.

advertisement scroll to continue

–>

–>