A new government study reveals vehicle prices are falling, but car insurance has skyrocketed

April 12, 2024 at 19:30

–>

–>

–>

- New and used car prices have fallen, but car insurance costs have skyrocketed.

- The increases are being blamed on a variety of factors including complicated repairs, expensive components, and supply chain issues.

- A study suggests the average cost of full coverage jumped 24% last year.

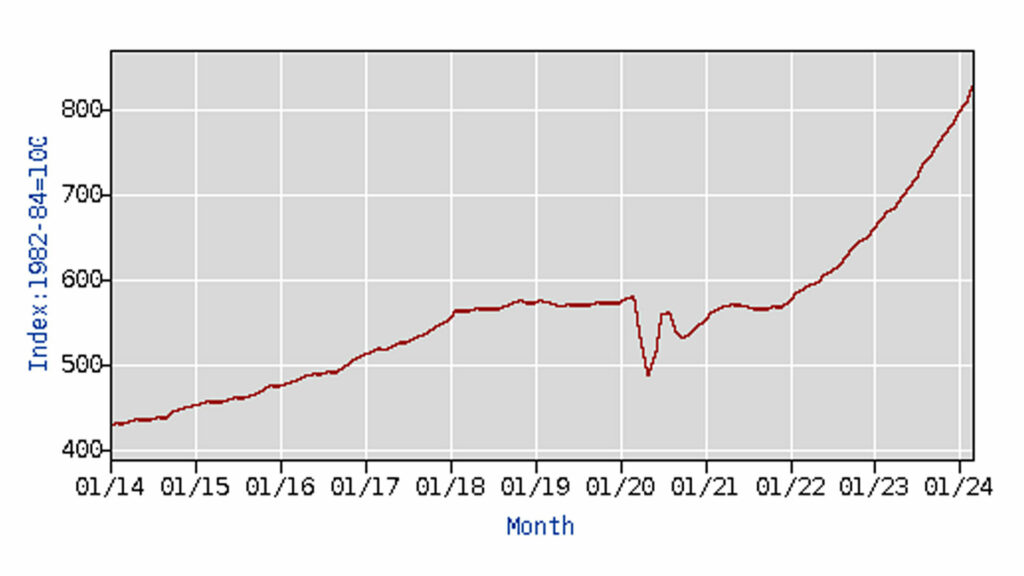

If your insurance rates have been climbing, you’re not alone as the U.S. Bureau of Labor Statistics revealed the Consumer Price Index rose 0.4% last month. Drivers were hit particularly hard as there were increases in the indexes for gasoline and motor vehicle insurance.

However, it wasn’t all bad news as “indexes for used cars and trucks, recreation, and new vehicles were among those that decreased over the month.” Furthermore, on an unadjusted 12 month basis, the new car index fell a tenth of a percent, while the index for used cars and trucks dropped 2.2%.

More: Used Car Prices Plummet 13.8% But Still Above Pre-Pandemic Levels

That’s welcome news, but virtually everyone is getting hit by higher insurance costs. As the agency noted, “The motor vehicle insurance index rose 2.6 percent in March, following a 0.9-percent increase in February.”

That doesn’t sound like much, but insurance rates have skyrocketed since 2022. In particular, car insurance costs rose 22.2% in the past year and that’s one of the biggest increases in nearly five decades.

Reuters is reporting the increases can be blamed on a variety of factors including “rising costs associated with repairing increasingly complicated vehicles and more storm damage amid climate change.” On top of that, more cars are being totaled following accidents and there have been supply chain issues. The latter, combined with a shortage of mechanics, means insurance companies are paying more to put customers in rental cars when their vehicle needs to be repaired.

Citing Insurify, the publication says the average cost of full coverage jumped 24% last year and now costs over $182 a month. Millions are also paying more as a survey suggested 63% of drivers received a rate hike in 2023.

That’s a significant jump and a number of new vehicle owners have experienced sticker shock when getting insurance. As a result, it’s always good to shop around and keep your options open.